How Modular Processing Units Simplify Shale Gas Recovery Projects

What Is a Modular Processing Unit?

A modular processing unit is a prefabricated, skid-mounted gas treatment system manufactured in a controlled factory environment and then transported to the well site as a complete integrated package.

Unlike traditional “stick-built” facilities constructed entirely on-site, these units arrive 85–95% complete, requiring only interconnection and commissioning.

A typical modular system includes several core components mounted on standardized skids:

- Separation Module: Handles three-phase gas, oil, and water separation using gravity or cyclone technology. Modern designs can process 5 to 50 MMscfd (million standard cubic feet per day) within a compact footprint.

- Dehydration Unit: Removes water vapor to meet pipeline specifications, typically using triethylene glycol (TEG) or membrane separation technology. The target dew point range is –20°F to –40°F, depending on delivery requirements.

- Compression System: Provides pipeline boosting, commonly with reciprocating or screw compressors equipped with variable frequency drives to adapt to fluctuating production.

- Control and Safety System: An integrated PLC/SCADA platform enables remote monitoring and automatic shutdown sequences — essential for unmanned operation in remote locations.

The essence of this approach is standardization. Traditional facilities require months of custom engineering, while modular manufacturers maintain proven designs that fit 80% of shale gas applications.

This concept mirrors how the automotive assembly line revolutionized car manufacturing — achieving efficiency through repetition and consistency.

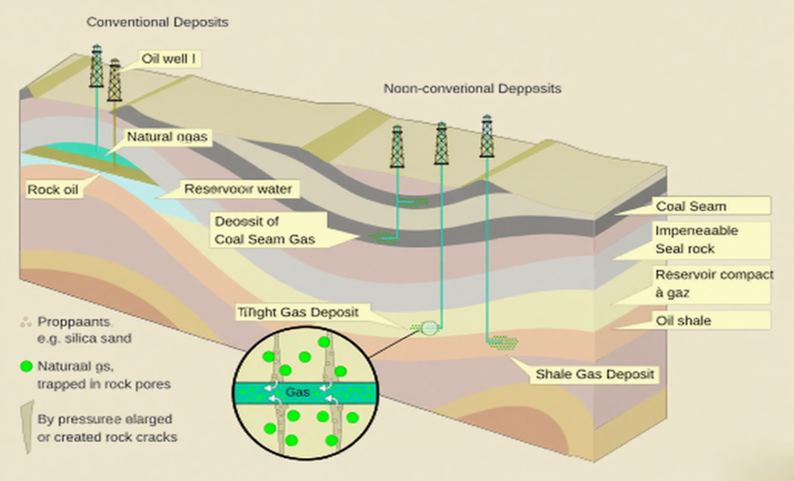

Related Reading: How Is Shale Gas Formed? — An in-depth exploration of the geological origins, formation process, and reservoir characteristics of shale gas. It explains how organic deposition, thermal maturity, and gas trapping make shale gas a cornerstone of global energy transition. The article also introduces major shale gas regions and advanced extraction technologies such as horizontal drilling and hydraulic fracturing.

The Challenges of Shale Gas Recovery

Shale gas projects face unique obstacles that make traditional infrastructure methods problematic:

- Rapid Production Decline: Shale wells typically decline 60–70% in the first year, compared to 15–20% for conventional wells (U.S. Energy Information Administration, 2024). This steep curve makes large, fixed facilities difficult to sustain, as long-term output may not justify the investment.

- Geographical Constraints: Many productive shale formations are located in remote areas with limited infrastructure. For example, Ohio’s Utica Shale spans rural counties where mobilizing crews and materials can cost 40–60% more than in developed regions.

- Capital Efficiency Pressure: Due to volatile oil and gas prices, operators demand shorter payback periods — typically under three years. Traditional facilities costing $15–25 million often struggle to meet this target, especially when production volumes are uncertain.

- Regulatory Complexity: Stricter emissions standards, particularly for volatile organic compounds (VOCs) and methane, require sophisticated control systems. Modular units can integrate these technologies during factory assembly, ensuring compliance from day one.

How Modular Units Transform Project Economics

1. Accelerated Time to Production

The timeline advantage is substantial.

Traditional gas processing facilities follow a sequential process:

Design (6–8 months), Procurement (4–6 months), Construction (12–18 months), and Commissioning (2–3 months) — totaling 24–35 months.

Modular processing fundamentally compresses this timeline:

| Activity Phase | Duration | Notes |

| Design & Selection | 2–3 months | Standardized platforms |

| Factory Manufacturing | 4–6 months | Runs parallel to site prep |

| Transportation | 1–2 weeks | Standard freight methods |

| Site Installation | 2–4 weeks | Bolt-down and interconnect |

| Commissioning | 2–4 weeks | Pre-testing reduces issues |

| Total Project Time | 6–9 months | 60–75% faster than traditional |

This acceleration stems from parallel engineering. While the manufacturer builds equipment modules, on-site crews prepare foundations and utilities simultaneously.

Factory-controlled fabrication eliminates weather delays common in field construction — no frozen ground in January, no extreme heat in August.

Commissioning benefits are particularly noteworthy.

Traditional plants undergo extensive field testing to identify design flaws, installation errors, and equipment failures. Modular units, however, arrive 90% factory-tested as proven systems.

One operator reported reducing commissioning time from 12 weeks to just 3 weeks — a 75% improvement.

2. Capital Cost Comparison (50 MMscfd Capacity)

| Cost Category | Traditional Facility | Modular Solution | Savings |

| Engineering & Design | $1.8M | $0.9M | 50% |

| Equipment & Materials | $8.2M | $7.1M | 13% |

| Site Labor | $4.5M | $1.4M | 69% |

| Project Management | $1.2M | $0.6M | 50% |

| Delivery & Commissioning | $0.8M | $0.4M | 50% |

| Contingency (10%) | $1.6M | $1.0M | 38% |

| Total CAPEX | $18.1M | $11.4M | 37% Savings |

Source: Based on Wood Mackenzie’s 2024 Midstream Infrastructure Report and operator project data.

These savings arise from multiple factors.

Factory labor costs are lower than on-site construction — skilled technicians work year-round in controlled conditions rather than remote, high-cost field locations.

Material management improves significantly through centralized procurement and secure warehousing, reducing theft and weather damage.

The shortened timeline also yields hidden financial benefits.

Traditional facilities incur up to three years of carrying costs before generating revenue — including land leases, insurance, and project management.

Modular units cut this period in half, accelerating cash flow and improving Net Present Value (NPV) by 15–25% (Rystad Energy, 2023).

Operational Flexibility

Perhaps the most underrated advantage is adaptability.

Shale gas production is inherently uncertain — actual well output often diverges from forecasts. Modular architectures allow operators to align infrastructure with real conditions rather than betting on projections.

Consider a phased deployment strategy:

- Start with 20 MMscfd capacity serving initial wells. If production exceeds expectations, add another 15 MMscfd module within four months. If wells underperform, defer expansion and avoid stranded capital.

- Scalability extends through the asset lifecycle. When a well site becomes uneconomic, modules can be redeployed to new drilling areas. The active secondary market for modular equipment means units retain 40–60% of their original value after five years, far higher than near-zero residual value for fixed plants.

- Technology upgrades become feasible. Replace an aging compression module with a modern, high-efficiency unit without shutting down the entire facility — nearly impossible with traditional integrated plants.

Choosing the Right Approach

| Factor | Modular Preferred When | Traditional Preferred When |

| Production Volume | <100 MMscfd | >150 MMscfd (Economies of Scale) |

| Project Timeline | <12 months to first gas | >24 months acceptable |

| Production Certainty | High decline or uncertainty | Proven long-term reserves (15+ years) |

| Location | Remote, limited infrastructure | Near existing facilities |

| Capital Availability | Limited CAPEX budget | Ample funding, focus on lowest unit cost |

| Future Plans | Multiple development areas | Single long-term site |

| Regulatory Outlook | Uncertain future requirements | Stable regulatory environment |

| Resale Value | Need asset flexibility | No relocation expected |

KAITIANGAS: Your One-Stop Shale Gas Recovery Partner

KAITIANGAS specializes in innovative shale gas recovery solutions designed to maximize resource utilization while minimizing environmental impact.

The company provides end-to-end services — from feasibility consulting and engineering design to EPC execution and commissioning — helping energy producers meet regulations, ensure sustainability, and maintain productivity.

Since its founding in 2002, KAITIANGAS has accumulated extensive experience in shale gas recovery and liquefaction.

With proprietary modular skid-mounted liquefaction systems, the company offers complete capabilities across resource evaluation, process design, equipment fabrication, EPC contracting, and system commissioning.

Whether your project is in North America, Asia, or Europe, KAITIANGAS delivers efficient and responsible shale gas recovery solutions tailored to your goals.

Conclusion

Modular gas processing technology has evolved from an experimental concept into mainstream infrastructure.

For most applications, performance differences compared to traditional facilities are negligible — yet the speed, cost, and flexibility advantages are increasingly decisive.

Market data reinforces this shift.

Global modular gas processing equipment sales reached USD 4.2 billion in 2024, with a projected CAGR of 8.7% through 2030 (Grand View Research, 2024).

North American operators lead adoption, but international markets — particularly Argentina’s Vaca Muerta Shale and China’s Sichuan Basin — are rapidly following.

For shale gas developers, the strategic takeaway is clear:

For projects below 100 MMscfd, modular processing should now be the default choice.

The burden of proof has shifted — you now need a compelling reason to choose traditional construction rather than to justify modular adoption.

Technology continues to advance.

Next-generation designs incorporate advanced automation, predictive maintenance algorithms, and integrated emissions monitoring.

Some manufacturers now offer fully electric systems, eliminating combustion-based power — a critical advantage amid tightening carbon regulations.

For your next shale gas development project, start by evaluating a modular option.

The six months and millions of dollars saved could be the difference between breaking even and achieving exceptional returns.

References

- Grand View Research. (2024). Modular Gas Processing Market Size, Share & Trends Analysis Report. Market Research Report.

- Rystad Energy. (2023). Midstream Infrastructure Cost Benchmarking Study. Industry Analysis Report.

- U.S. Energy Information Administration. (2024). Annual Energy Outlook 2024 with Projections to 2050. DOE/EIA-0383(2024).