Is Flare Gas Recovery Economically Viable for Low-Volume, Remote Wells in the Permian Basin?

The Permian Basin is the beating heart of U.S. oil production — and one of the most significant sources of flared associated gas worldwide.

While major operators have already implemented centralized flare gas recovery (FGR) systems, thousands of small, remote, and low-volume wells still burn off valuable natural gas daily.

With the Texas Railroad Commission (RRC) tightening flare permit requirements, the EPA’s methane fee set to rise, and ESG expectations becoming the new normal, flare gas recovery is shifting from an option to an obligation.

But a tough, pragmatic question remains on every field manager’s desk:“For my small, remote wells — does installing a flare gas recovery system make economic sense, or is it just an expensive ESG box to tick?”

But here’s the reality:

- For most low-volume, remote wells (<100 Mscf/d), traditional flare gas recovery is rarely viable.

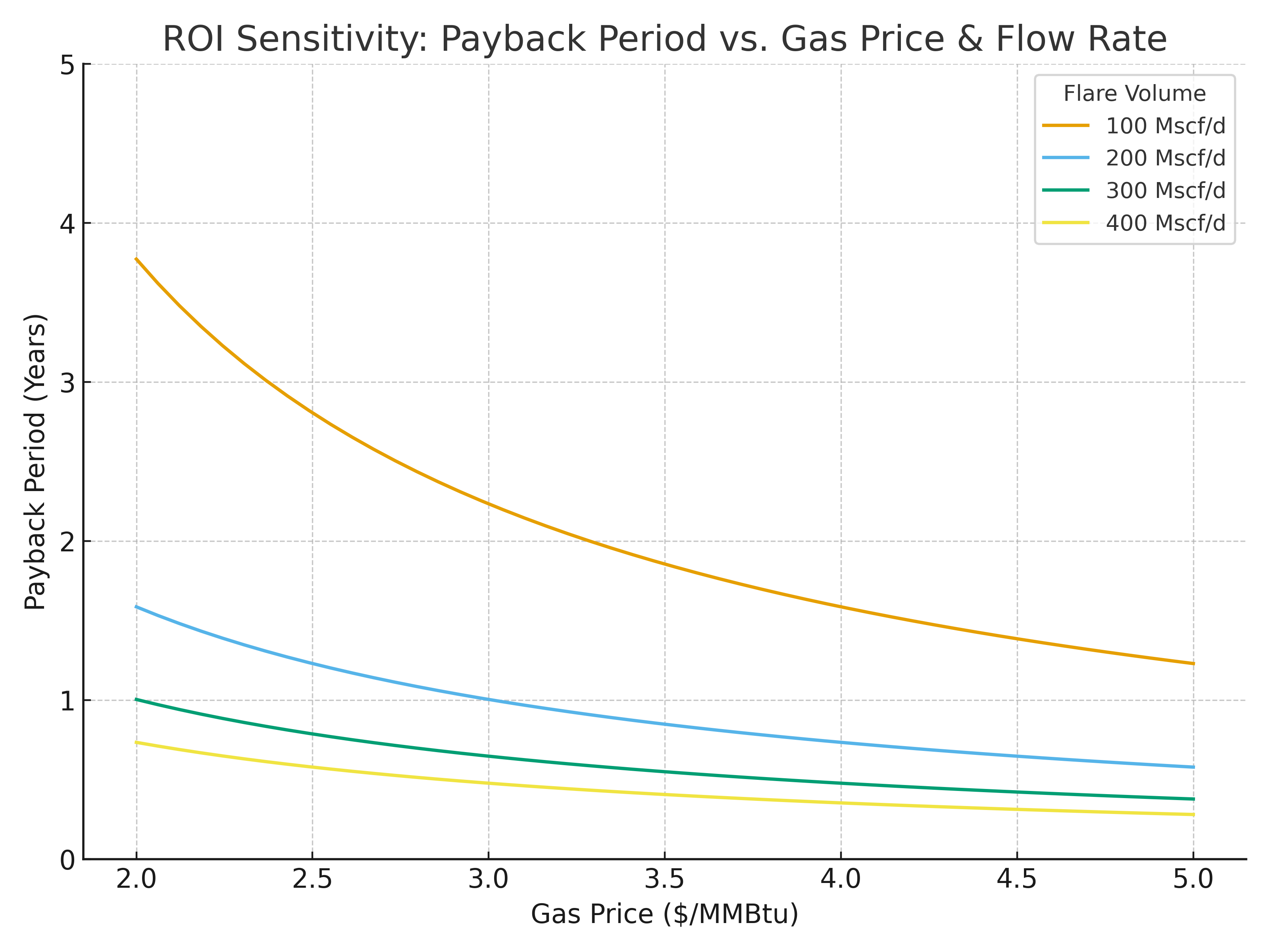

- For wells producing 100–300 Mscf/d with ≥3 years of remaining life — especially where gas can offset on-site power or qualify for carbon credits — FGR projects can achieve payback within 2–3 years.

- In the Permian Basin, modular and service-based FGR models are transforming the economics from “impossible” to “conditionally profitable.

Why Low-Volume, Remote Wells Are the “Hardest Nut to Crack”

Flare gas recovery at large processing plants is well understood.

The challenge lies in distributed, low-rate, remote sites that dominate the tail end of Permian production.

- Low and variable gas flow (<200–500 Mscf/day) makes it hard to spread fixed CAPEX.

- Distance from pipelines and power increases logistics costs.

- Harsh site conditions (dust, heat, limited supervision) impact reliability.

- Conventional FGR systems were designed for high-volume facilities — often too large, expensive, or complex.

- According to the World Bank’s Global Gas Flaring Reduction data, roughly one-third of Permian flaring comes from small, isolated pads with no practical route to market.

For these sites, the problem isn’t lack of will — it’s the lack of a right-sized, financially rational solution.

What are the flare gas recovery solutions?

Operators considering FGR at remote sites must match technology scale to production profile. Here’s a breakdown of the main categories:

| Approach | How It Works | Best Fit | Key Limitations |

| Conventional FGRU (compressor + reinjection) | Captures gas, compresses for reinjection or sales | Centralized pads, >500 Mscf/d | High CAPEX/OPEX |

| Gas-to-Power (microturbine or generator) | Converts gas to on-site electricity | Remote pads with power demand | Efficiency loss during downtime |

| Modular/Portable FGRU (skid units) | Compact compressor with automated controls | Temporary or low-flow wells | Throughput limitations |

| CNG-in-a-Box / LNG mini plants | Compress or liquefy gas for trucking | Clustered remote sites | Transport cost |

| Shared Hub Recovery | Connects multiple wells to one central FGR system | Well clusters with short tie-ins | Requires coordination |

| Lease or “as-a-service” FGR | Vendor owns and operates unit, charging by month or volume | CAPEX-sensitive operators | Long-term OPEX exposure |

Trend: FGR solutions are moving toward modularity and mobility — smaller, smarter, and faster to deploy.

Economic Feasibility Analysis: Breaking Down the Breakeven Equation– The CAPEX/OPEX/ROI Framework

The key to viability lies in balancing CAPEX + OPEX against gas revenue + avoided penalties + carbon credits.

Typical Cost & Performance Parameters

| Parameter | Estimated Range | Comment |

| CAPEX | $150,000 – $400,000 | Modular skid-mounted FGR unit |

| OPEX | $10,000 – $25,000/year | Power, maintenance, monitoring |

| Recovered Gas Volume | 100 – 300 Mscf/d | Typical small pad flow |

| Gas Price (Henry Hub) | $2.5 – $4/MMBtu | As of 2025 |

| Payback Period | 2 – 4 years | Depending on flow and uptime |

Example: 100 Mscf/d Site

- Gas price: $3/MMBtu

- Recovery efficiency: 90%

- CAPEX: $200,000

Recovered value:

100 × $3 = $300/day → $109,500/year

Payback: ~1.8 years (excluding methane fee savings and carbon credit revenue)

When compliance incentives are included, annual ROI can exceed 40–60%.

Technology Innovations for the “Small, Scattered, and Remote” Wells

Modern FGR solutions are being redesigned for the distributed asset reality of the Permian Basin.

- Modular FGRU skids: Plug-and-play units deployable in <2 weeks, easily relocated as wells decline.

- Service-based FGR models: Third-party providers install and operate systems, charging monthly or per-Mscf fees.

- AI-driven remote monitoring: Enables predictive maintenance and minimal field visits.

- Flare-to-Power microgrids: Recovered gas runs microturbines for on-site power, reducing diesel costs.

- Clustered recovery hubs: Neighboring wells share one recovery unit, optimizing CAPEX utilization.

These innovations are transforming FGR from a heavy infrastructure project into a scalable, service-oriented solution.

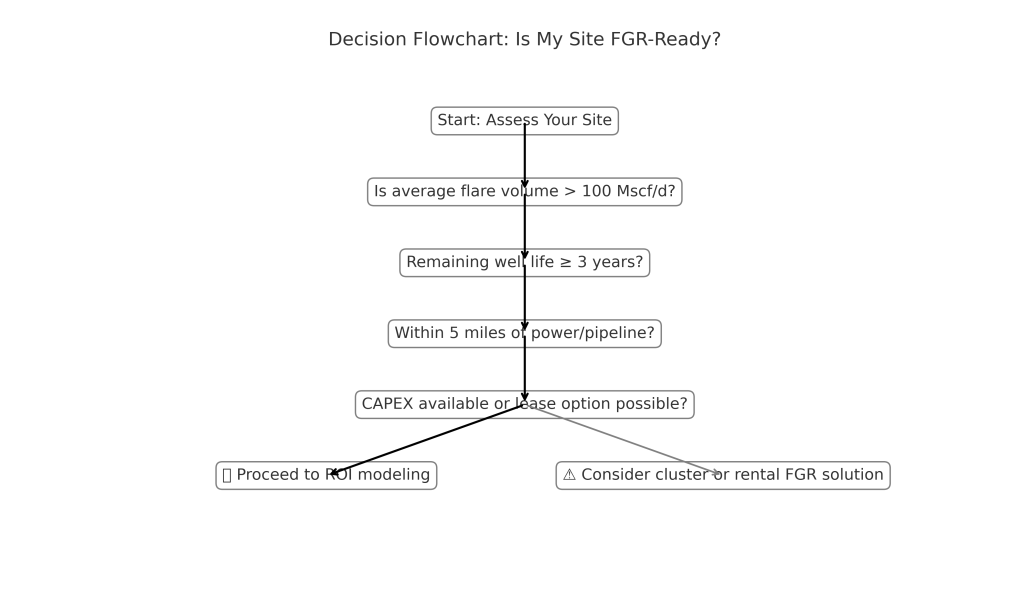

Is Your Well a Good FGR Candidate?

To simplify decision-making, the following screening matrix helps determine whether flare gas recovery could be economically justified.

| Dimension | Indicator | Guideline |

| Gas Flow Rate | >100 Mscf/day | Minimum for breakeven potential |

| Proximity to Infrastructure | <5 miles to power/pipeline | Enables gas use or sales |

| Remaining Well Life | ≥3 years | Allows ROI recovery |

| Operational Capability | Remote monitoring available | Reduces downtime |

| Regulatory Pressure | High compliance exposure | Strengthens ROI case |

If 3 or more criteria are met, proceed with a site-specific ROI model or feasibility study.

Otherwise, consider hub-sharing or rental-based FGR models.

Conclusion

For remote, low-volume wells, flare gas recovery was once economically unthinkable. Today, regulatory, environmental, and technological trends have changed the equation.

The right combination of gas volume, site longevity, and modular technology can make FGR projects both profitable and compliant.

- For wells >100 Mscf/d and >3 years of life, 2–3 year payback is realistic.

- Modular and service-based FGR systems now enable flexible deployment.

- Avoided methane fees and carbon credits are significant ROI drivers.

- The decision should be data-driven, not ideological — every site has a threshold.

In the Permian Basin and beyond, flare gas recovery is no longer a sunk cost — it’s becoming a strategic pathway to operational efficiency and ESG leadership.

Curious if flare gas recovery makes sense for your wells?

KAITIANGAS can model site-specific ROI, gas capture efficiency, and regulatory benefits for your Permian assets.