Restructuring World LNG Supply and Demand Frameworks Due to Demand Shifts

In the last ten years, liquefied natural gas (LNG) has changed its character from a regional rather insignificant energy source to a major player of the global energy system, demonstrating strong LNG demand growth and strategic importance for energy security. That said, coming to the year 2025–2026, a definite market change has been signalled: the problem of LNG supply and LNG regasification has turned from “is there enough” to “where, what standards and how efficiently it can be absorbed?”

LNG Demand Continues to Grow Amid Shifting Supply–Demand Structures

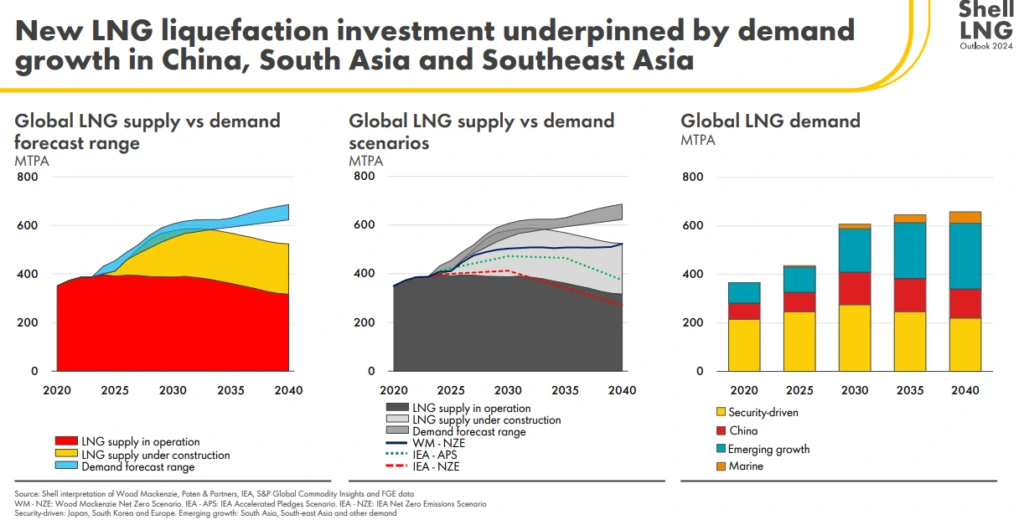

In the long term, LNG Demand Growth remains strong, driven mainly by emerging Asian economies like China and India. However, short-term trade shows divergence: 2024–2025 global LNG trade slowed to near-decade lows, reflecting the influence of prices, alternative energy, and regional policies. Some Asian markets saw temporary import declines, while Europe continues to rely on LNG for Energy Security. The IEA emphasizes that future markets will depend on long-term contracts, diversified supply, and adaptable infrastructure. Overall, LNG demand has not peaked, but growth is shifting from “volume-driven” to “structure-driven,” with focus on demand distribution, gas quality, and system absorption rather than simple expansion.

Rapid LNG Supply Expansion Reshapes Supply–Demand Dynamics

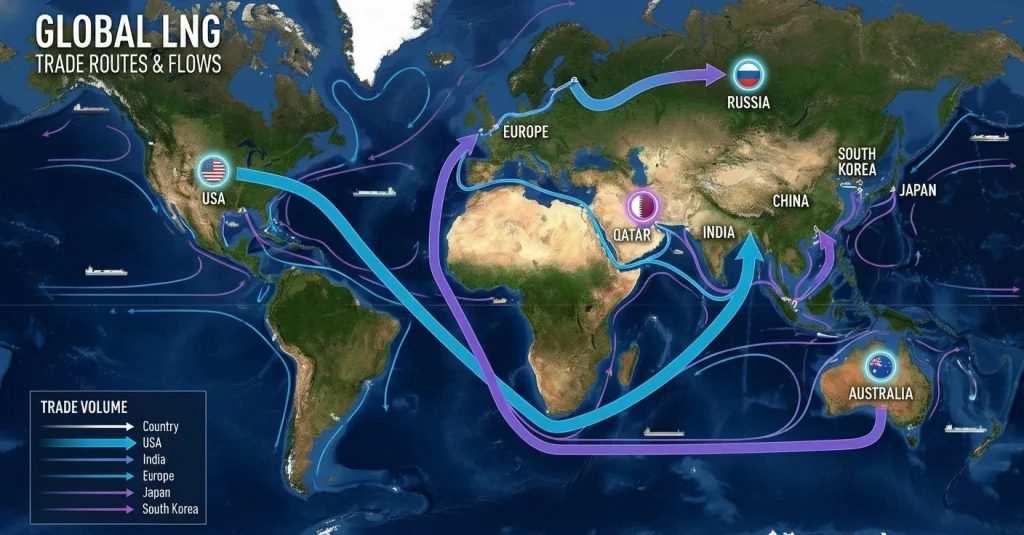

The expansion of the global LNG supply is indeed a very fast one. The capacity for global liquefaction is said to increase by 40% according to IEEFA, from the present 474 million tons per annum in 2024 to 666 million tons per annum by the year 2028, with the year 2026 being a record in new capacity mainly coming from the US, Qatar, Russia, and Canada. The government predicted an annual increase of almost 24% for US. LNG exports which reached 111 million tons in 2025, besides a further rise in 2026, thus cementing the US position as the world’s top LNG exporter and the most significant contributor to the trade cycle.

Nevertheless, the demand for new capacity is still a big question mark; if this situation persists, there is a risk of long-term oversupply accompanied by low prices. At the same time, the market structures are changing as evidenced by an increasing number of short-term contracts and spot trades, which do not only reveal how the LNG supply expansion is altering the trading mechanisms but also the risk distribution as well.

Three Major “Mismatches” in the Supply–Demand Structure

The LNG market worldwide is under pressure from two sides: the fast growth of supply and the varied locations of demand. This situation has led to the emergence of three significant mismatches: the regional one, the gas quality one, and the timing one. These mismatches have a direct impact on trading and logistics, and at the same time, they are increasing the requirements for LNG regasification, peak shaving, and gas purification.

Regional Mismatch

In the context of new LNG supply, it is seen that the major exporting countries such as the US, Qatar, Russia, and Australia are taking a major share while in the meantime, the demand is coming from a large number of regions with less infrastructure, particularly the emerging markets. The situation is very much like the bottlenecks of LNG receiving terminals, regasification plants and integration of pipelines in the downstream. A case is made by the following points to illustrate such a problem:

- Gas cannot reach: Emerging markets’ demands for gas cannot be met because of lack of receiving terminals or pipelines.

- Gas arrives but cannot be fully used: Even if LNG reaches the port, utilization is constrained by LNG Regasification, purification, or pipeline limitations.

The IEA report estimates that by the year 2025, about 70% of the new LNG capacity will be located in the top five exporting nations, while receiving capacity in Asia and Europe will be insufficient, thus creating a situation where regional mismatches cannot be easily resolved in the short term.

Gas Quality Mismatch

As global LNG sources diversify, gas composition differences between suppliers have become significant, directly affecting downstream grid connection, power generation, and industrial use. Typical LNG quality variations include:

| Parameter | Typical Range | Impact on Downstream Use | Notes |

| Methane (CH₄) | 87% – 99% | High methane LNG has heat value close to natural gas standard; low methane requires conditioning | High methane usually from US and Alaska dry gas sources |

| Ethane (C₂) | 0% – 10% | Affects heat value and Wobbe index; high proportion requires adjustment | Some Middle East and Australian LNG has higher ethane |

| Propane (C₃) | 0% – 5% | High propane increases heat value but may affect combustion stability | Adjusted via LNG conditioning |

| Nitrogen (N₂) | 0% – 1% | High nitrogen lowers heat value | Found in some Russian and African gas sources |

| CO₂ | 0 – 50 ppmv | Reduces heat value and impacts combustion & safety | Requires decarbonization |

| H₂S | 0 – 4 ppmv | Corrosive; affects emissions | Requires desulfurization |

| Water (H₂O) | 0 – 0.1% | Freezing risk; impacts LNG Regasification | Requires drying |

| Heat Value (HHV) | 39.4 – 46.0 MJ/Nm³ | Affects combustion efficiency | Influenced by ethane & propane content |

| Wobbe Index | 52.7 – 56.9 MJ/Nm³ | Indicates gas interchangeability; large differences affect safety | Adjusted via conditioning |

The different characteristics of LNG make it impossible to be simply “unloaded and used.” Best LNG regasification plants need very high-tech systems for purification, conditioning, and quality control to bring the heating value and Wobbe index up to the level required for safe and efficient operation of city gas pipelines, power plants, and industrial users. The International Energy Agency forecasts that worldwide investment in terminal purification and conditioning will go over USD 5 billion in the next five years, which emphasizes that the issue of gas quality mismatch is a main factor influencing the efficiency of supply absorption.

Timing Mismatch

LNG timing mismatches occur due to the fact that projects have long investment cycles of 5–8 years, while the demand in the downstream sector is affected by various factors including seasons, climate, economic cycles, and policy changes. Consequently, there are simultaneous periods of apparent surplus, such as in the exports of summer 2024, which are to be at 107 million tons down 8% from the peak, and short-term tightness, for example, the substantial increase in LNG imports in Europe during the energy crisis of 2022–2023, which was by 20%.

Meanwhile, LNG infrastructure and markets are changing: Europe and East Asia have already invested in storage and tanks; Japan and South Korea are taking advantage of short-term peak-shaving contracts and spot trades; North America’s pipelines are equipped with compressors and interconnections; liquefaction and pipeline systems are implementing rapid start-stop with smart monitoring. These changes provide flexibility, quicker reaction time, and improved use of technology, thus becoming the determining factors in the competitiveness of the future LNG supply chain.

Infrastructure and Purification Capabilities Become the New Competitive Focus

Infrastructure and gas purification have become the main competitive factors due to global LNG supply expansion and demand that is becoming more and more complex. Most of the new capacity is located in a few countries that export LNG, while the demand is spread unevenly which makes receiving terminals, LNG regasification, pipeline integration, and storage very important for both efficiency and responsiveness. The different qualities of multi-source LNG (methane 87%–99%, CO₂ 0–50 ppmv, H₂S 0–4 ppmv, heat value 39.4–46.0 MJ/Nm³, Wobbe index 52.7–56.9 MJ/Nm³) necessitate advanced purification and conditioning. Short-term demand fluctuations and seasonal peaks greatly emphasise the need for flexible storage, peak shaving, and rapid response. Firms with robust infrastructure and efficient gas treatment are best positioned to manage mismatches and enhance Energy Security and market competitiveness.

Key Directions for the Next 3–5 Years

Over the next three to five years, the global LNG market will emphasize LNG Demand Growth, gas quality consistency, infrastructure flexibility, and market mechanism innovation. Regional demand divergence in Asia, Europe, and North America will sustain mismatches, with China and India driving Asia’s LNG Demand Growth up 3%–4% annually. Multi-source LNG quality variations (methane 87%–99%, CO₂ 0–50 ppmv, H₂S 0–4 ppmv, heat value 39.4–46.0 MJ/Nm³, Wobbe index 52.7–56.9 MJ/Nm³) require LNG Regasification terminals and pipelines to ensure high-efficiency purification and conditioning, with over USD 5 billion in related investments expected. Europe and East Asia are expanding storage, Japan and South Korea are introducing short-term peak-shaving contracts, and North American pipelines are enhancing interconnection and scheduling. Increasing short-term contracts and spot trades will further strengthen supply chain responsiveness, making integrated LNG Supply capacity, infrastructure, and market mechanisms key to competitive advantage.

Conclusion

LNG is evolving from a “scarce energy” commodity to a “system engineering” type of commodity. The demand is still there, but the situation is different; the supply is increasing but the challenges are more intricate.

The infrastructure capacity, LNG regasification technology, and system integration are the main factors that determine the competitiveness of the market in this new supply-demand structure. This means that the real value of the industry is being more and more concentrated in the midstream operations and technology.